How to Trade EU Carbon Credits

Trade EU Carbon Credits

The European Union Emissions Trading Scheme (EU ETS) is the EU’s main tool for cost-effectively reducing emissions of greenhouse gases, including carbon dioxide, from energy and industry. It is based on the ‘cap and trade’ principle. A limit is set on the total volume of allowed emissions and companies that operate in regulated installations, such as power plants and large energy users and airlines, can buy or sell allowances to each other if they need more or less than their total allocation.

The EU ETS covers over 10,400 industrial and power installations as well as 350 airlines in the 28 EU Member States plus Iceland, Liechtenstein and Norway. It is currently the world’s largest installation-level emission trading system and one of the most important elements of the EU’s climate policy to reduce greenhouse gas emissions. The system’s price signal incentivises investment in the low-carbon economy and makes it economically advantageous to switch from polluting to environmentally friendly technologies.

By enabling the transfer of trade carbon credits permits to other installations, the allocation mechanism can also help correct for concerns over loss of competitiveness and possible “leakage” of emissions outside the EU. However, this is a temporary solution. It would be more effective to address the issue through border adjustments, where imports are taxed according to their carbon content.

How to Trade EU Carbon Credits

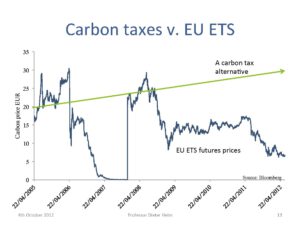

The price of emissions allowances is set each year by the EU Commission and reflects its assessment of the current climate situation and future trends. The auctioning of emissions permits is a crucial part of the EU ETS. In addition, a reserve pool is established to ensure that the volume of permits allocated annually remains stable, even in the event of major economic events or extraordinary natural phenomena.

Since its launch in 2005, the EU ETS has grown to be the biggest market for the sale of carbon credits and now accounts for more than three-quarters of international trading. The price of a carbon credit, which represents the right to emit a certain amount of CO2 in a year, is determined by supply and demand factors. In general, a carbon credit is worth more when there is more demand for it, and vice versa.

In the long term, a stable price will be needed to make it viable for companies to invest in low-carbon technology and to shift from fossil fuels to renewable energy sources. This will require rich countries to demonstrate that a transition to a low-carbon economy is feasible and can be compatible with economic prosperity. Domestic action will drive investments towards a low-carbon economy, which in turn will encourage developing countries to follow suit.

The aim of this beginners’ guide is to build knowledge about the EU’s carbon market among civil society organisations that have little or no experience with climate policies, in particular those from countries in the EU’s neighbourhood. This increased awareness should ultimately empower them to get involved in the EU ETS process and advocate for an effective European carbon market.

No Comment